Peabody Delivers Nearly 1,400 Homes as it Focuses on ‘Getting the Basics Right’

The housing association Peabody anticipates an operating margin comparable to the previous year. In the 2023/24 period, Peabody completed 1,381 homes, a 42% decrease from the 2,399 homes finished the prior financial year, according to an unaudited trading update.

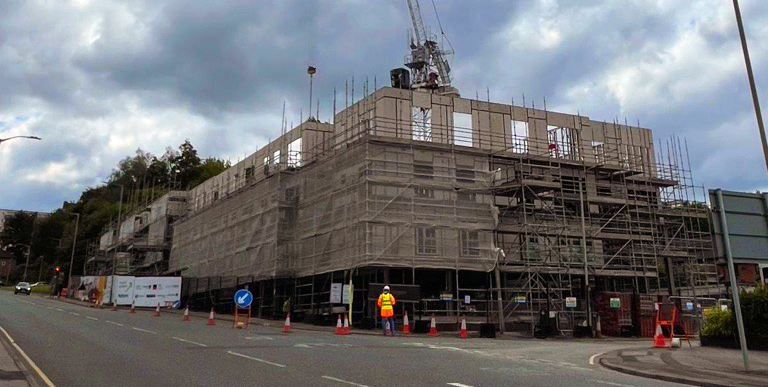

Over the 12 months ending in March, Peabody invested £533 million in new housing developments, initiating 1,157 new projects, down from 2,376 the previous year.

The update, released before the annual report due later this year, revealed a turnover of £992 million for 2023/24, with £855 million derived from core operations, including £774 million from social housing lettings.

Peabody stated its operating margin is expected to remain at last year’s level of 23%, despite facing “significant cost pressures.” During this period, the organization allocated £374 million for existing homes, including £64 million for fire safety remediation and £175 million for planned maintenance and responsive repairs.

Nearly 80% of Peabody’s homes now have an EPC rating of C, following a £135 million investment aimed at improving the condition and environmental performance of their properties

Ian McDermott, Peabody chief executive, said: “This has been a year of good progress but we know there is much work to do. We’re transforming our services and investing in homes and sustainable places for the long-term.

“Our local focus and commitment to getting the basics right remains a strategic priority. Our plan is to spend around £2bn over 5 years – or around £1m a day – on improving and maintaining residents’ homes.

“This is the right thing to do and will bring material benefits. Over time it will help to reduce the volume of responsive repairs and complaints and improve residents’ satisfaction with our landlord services.”

This marks Peabody’s second year of trading with Catalyst Housing and its subsidiaries integrated into the group. Following a post-merger review, Peabody’s group board has initiated a project to sell commercial land and other non-core assets.